What is a donor advised fund?

A donor advised fund (DAF) is an account created at a sponsoring organization, such as a community foundation, for the purpose of charitable giving. The sponsoring organization manages the account, and the donor recommends how to invest the funds as well as where and when to donate them.

For Catholic funders who want to give in a manner that reflects their values, establishing a donor advised fund with a Catholic community foundation is a great option.

In short, a donor advised fund:

- Is a way to invest assets for charity

- Allows you a say in what organizations receive support

- Provides tax benefits upon donation to the donor advised fund

How do donor advised funds work?

Essentially, you would open a donor advised fund with a 501(c)(3) organization, such as a community foundation. That charitable organization can then, at your request, distribute your funds to IRS-classified charities, and will manage the paperwork.

You or a designated advisor can recommend grants and charitable gifts from the donor advised fund, specifying the requested amount and which organizations you would like to receive funding. When you contribute money or other assets to your donor advised fund, you receive an immediate tax deduction. You can contribute to the donor advised fund whenever you like and can generally recommend that grants be issued from the fund according to your preference.

How do you set up a donor advised fund?

Before you set up a donor advised fund, you’ll need to choose an organization where you can establish the fund, such as a community foundation or financial institution.

Every organization is a little different, so do some research and compare options before you ultimately decide. Factors that influence your decision may include fees and interest rates. Some organizations may stipulate a minimum contribution or require minimum amounts for distribution.

Once you narrow your search, contact the organization to discuss requirements in depth. Some organizations place restrictions on funding recipients—for example, Catholic community foundations only distribute to organizations in line with Catholic values. If it is important to you that your resources are used in ways that support Catholic morality, a donor advised fund is a great option.

Many Catholic community foundations also provide the opportunity to invest the assets of your fund in ethical and moral industries. This allows your assets to grow in a way that makes a positive impact in the world. Investing your assets allows for tax-free growth that can be distributed to the charitable causes most important to you.

Once you narrow your search, contact the organization to discuss requirements in depth. Some organizations place restrictions on funding recipients—for example, Catholic community foundations only distribute to organizations in line with Catholic values. If it is important to you that your resources are used in ways that support Catholic morality, a donor advised fund is a great option.

Many Catholic community foundations also provide the opportunity to invest the assets of your fund in ethical and moral industries. This allows your assets to grow in a way that makes a positive impact in the world. Investing your assets allows for tax-free growth that can be distributed to the charitable causes most important to you.

What are the benefits of a donor advised fund?

Giving through a donor advised fund at a Catholic community foundation ensures that the funds will support causes in line with Catholic teaching, even if they are distributed as part of an estate. Oftentimes, for funders who care about Catholic values, this is the most appealing benefit.

There are several other notable benefits to establishing a donor advised fund:

- Tax benefits, including an immediate tax deduction upon contribution to the donor advised fund. In some cases, you may still receive your deduction even when you give internationally.

- Because your funds are invested, they grow for greater charitable impact.

- A donor advised fund offers flexibility and control. You can strategically give small or large gifts to organizations you choose.

- From a legal and financial standpoint, it’s easier to give because the sponsor organization handles the majority of the paperwork.

- You may give anonymously or by name.

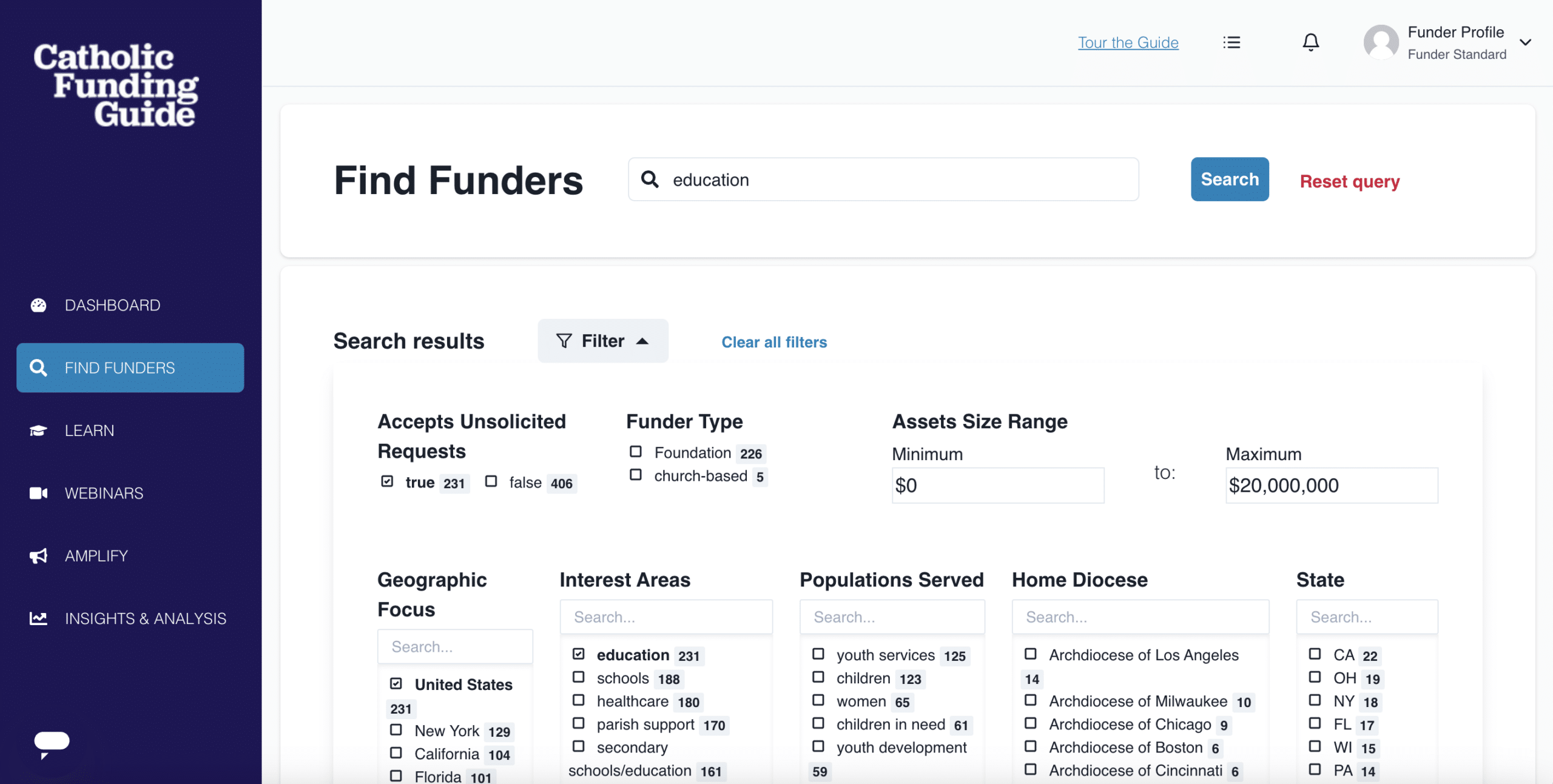

Did you know? As a funder, you can use the Catholic Funding Guide to find Catholic community foundations near you. With Amplify, a feature of the Guide, you can also search for charitable projects in need of funding. This can help you determine recipients for grants from your donor advised fund.

Still not sure if a donor advised fund is right for you? Learn more about starting a foundation—another beneficial way for philanthropists to give.